UPS & comScore: While E-Commerce Behaviors Differ by Region, Online Shoppers Generally Want More Flexibility

These days, online shoppers demand more flexibility from online retailers. They want to shop using multiple channels, get different payment and delivery options, and make easy returns. Free shipping is also becoming more important for online shoppers, since anything that is “free” is a driving factor in completing the sales process.

UPS (@UPS), a global leader in logistics and transportation services, and comScore (@comScore) recently released their second global study highlighting emerging trends from the leading e-commerce markets in Asia (mainland China, Hong Kong, Japan, Singapore, and South Korea); Brazil; Europe (France, Germany, Italy, the Nertherlands, Spain, and the United Kingdom); Mexico; and the United States.

Entitled UPS Pulse of the Online Shopper, a total of 19,485 respondents completed the survey. The survey was fielded between February and October 2014.

Major E-Commerce Trends from Different Markets

The unstoppable development of the Internet has allowed brands to reach out to consumers from around the globe more easily. However, in order to provide top-of-the-line services to their international customers, companies must understand the varying preferences of consumers from different markets. [See Figure 1]

To give brands an in-depth look into the major e-commerce trends across different regions, UPS and comScore detailed international consumer preferences in their 2015 report.

Figure 1 (Source: ThingLink/comScore)

According to the study, Asian online shoppers are “fast-paced shoppers” and “avid technology users” who continuously look for alternate delivery options. Forty-five percent of the respondents from Asia said they would prefer to have their orders delivered to locations other than their homes, while 33% would prefer to pick up their order at a local retail location authorized to hold their package. As fast-paced shoppers, Asian customers expect prompt action from retailers, with 27% expecting same-day shipping of the package, and a huge 48% expecting next-day shipping.

Online shoppers from Brazil are the “most advanced and social,” the study revealed. Fifty-six percent of purchases in Brazil are happening online, and some 64% of shoppers said they are influenced by reviews or posts on social media when deciding which products to purchase. However, Brazilian customers find shopping via mobile difficult, with 39% unable to get a clear product image, 31% unable to easily access product information, and 34% saying product comparison is hard. Compared to Asian shoppers, Brazilian customers are more patient when it comes to product shipping, with almost 40% saying they are willing to wait 11 days or more when free shipping is offered.

In Europe, shoppers are generally less reluctant to embrace the “new” when it comes to online shopping, with just 19% making purchases using their smartphones and 40% through retailer mobile apps. Shoppers are making 54% more in-store purchases than online. In terms of shipping, 52% prefer seeing the expected arrival date than days until the package’s arrival.

Mexican online shoppers, on the other hand, are identified as having an eclectic style of shopping, reflecting both the old and new retail landscape. They are avid in-store buyers whose primary concern is fraud-related delivery issues. Some 43% of Mexican customers use their smartphones to research products before buying in-store, and 60% prefer to purchase in a store window. Just 35% of online shoppers in Mexico have returned online purchases.

American online shoppers are “contemporary” customers who make most of their purchases on tablets compared to other markets. Free shipping is a significant factor in their online shopping experience, with 58% of American respondents willing to add items just to qualify for free shipping and 83% willing to wait two days longer if the shipping is free. Only 44% said they were satisfied with the flexibility of delivery, such as being able to adjust delivery days or reroute packages.

Boosting Customer Satisfaction Through Flexibility & Personalized Experiences

Amidst varying e-commerce habits, global consumers in general want to gain more control over their path-to-purchase—from their product research and retailer selection, to delivery options and returns. Called “flex shoppers,” they look for products efficiently, switching from one channel to another when researching and purchasing products.

This makes it extra crucial for marketers to create better experiences for customers across every channel and device.

“Consumers demand more from their package delivery experience, and today’s online shopper expects us to respond by creating solutions that are convenient for them,” said Alan Gershenhorn, UPS Executive Vice President and Chief Commercial Officer.

Here are other important takeaways from the report:

- Creating personalized experiences inspires customer loyalty.

The study found that the more retailers offer a personalized experience to consumers, the more consumers would remain loyal to retailers. The use of curated subscription services—a tactic offered by retailers to help consumers discover specific products based on their preferences or product purchase history—is widespread in Brazil, with over half (58%) of online shoppers enrolled in at least one service. The Asian and Mexican markets follow suit, with 48% and 46% of consumers enrolled in at least one curated subscription service, respectively.

- Research via mobile helps customers make purchasing decisions.

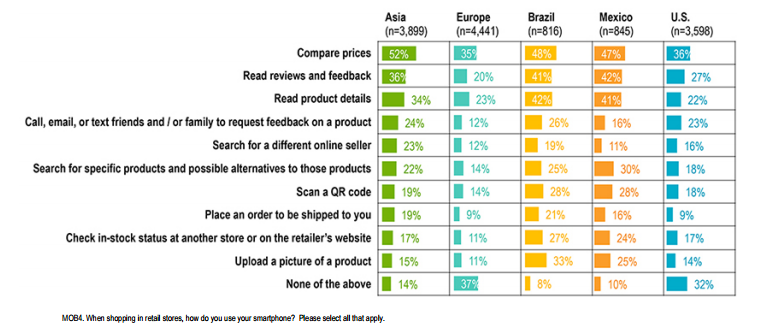

Global shoppers still make purchases using their desktop and laptop devices, but mobile continues to gain traction in consumers’ path to purchase. They increasingly use their mobile devices to research products before visiting a store, make purchases, and track deliveries. [See Figure 2]

These findings go hand-in-hand with a recent Google study that indicates mobile research influences purchase decisions across channels, with 93% of consumers who’ve used mobile to research products going on to make a purchase.

- Providing alternate options results in greater customer satisfaction.

As mentioned previously, there is a growing trend for alternate delivery options apart from home delivery. Asian shoppers lead all global customers, with almost half (46%) of respondents from this region saying they prefer to have their orders delivered to alternate locations other than their home whenever they’re unavailable to sign for a package.

For more details about emerging e-commerce trends across the globe, you may view the full UPS study here.

Marketing Digest Writing Team

Latest posts by Marketing Digest Writing Team (see all)

- How Taco Bell Struck Gold with Its Memorable Viral Marketing Campaigns - September 15, 2015

- Salesforce Marketing Cloud Releases New Instagram Marketing Tools - September 12, 2015

- Chrome Begins Pausing Flash Ads by Default to Improve User Experience - September 3, 2015