As mobile and tablet adoption continues to grow exponentially worldwide, it is only logical that such devices will play an increasingly important role in the way consumers look for and purchase products and services. In a report that was released earlier this year, eMarketer projects that 4.55 billion people will be using mobile phones in 2014. Mobile adoption is particularly accelerated in developing regions like the Middle East, Asia-Pacific, and Africa.

Another eMarketer report released in March 2014 projects that 190 million people in Western Europe will purchase via digital channels this year. A greater percentage of those purchases will be made on mobile devices due to the increased adoption of smartphones and tablets. On the flipside, compared to more developed mobile commerce markets—such as the United States, Japan, South Korea, and the United Kingdom—much of continental Europe is still in an “embryonic phase” when it comes to mobile commerce.

Steady Growth of Mobile Commerce in the EU5

Despite being in an “embryonic phase,” mobile commerce is experiencing steady growth in Europe, particularly in the EU5 countries of Spain, Germany, Italy, France, and the United Kingdom. comScore’s recent study on mobile commerce in the EU5—entitled “The Role of Mobile in Online Shopping and Buying”—was presented by Gian Fulgoni, co-Founder and Executive Chairman Emeritus of comScore Inc., at the e-Commerce Netcomm Forum in Milan, Italy in May 2014.

Mobile devices are altering the way consumers choose and buy products, as mobile devices allow consumers to easily research prices and features of different products and services on the go. In response to the steady growth of mobile commerce in the EU5, marketers and retailers are increasing their mobile marketing expenditures to reach their target audiences more effectively.

Data for the comScore study was sourced from comScore’s global panel of 2 million Internet users, and the panel was examined for different aspects of personal behavior, such as web visiting and search behavior; online advertising exposure; demographics, lifestyles, and attitudes; media and video consumption; as well as online and offline buying behaviors, among other behavioral aspects.

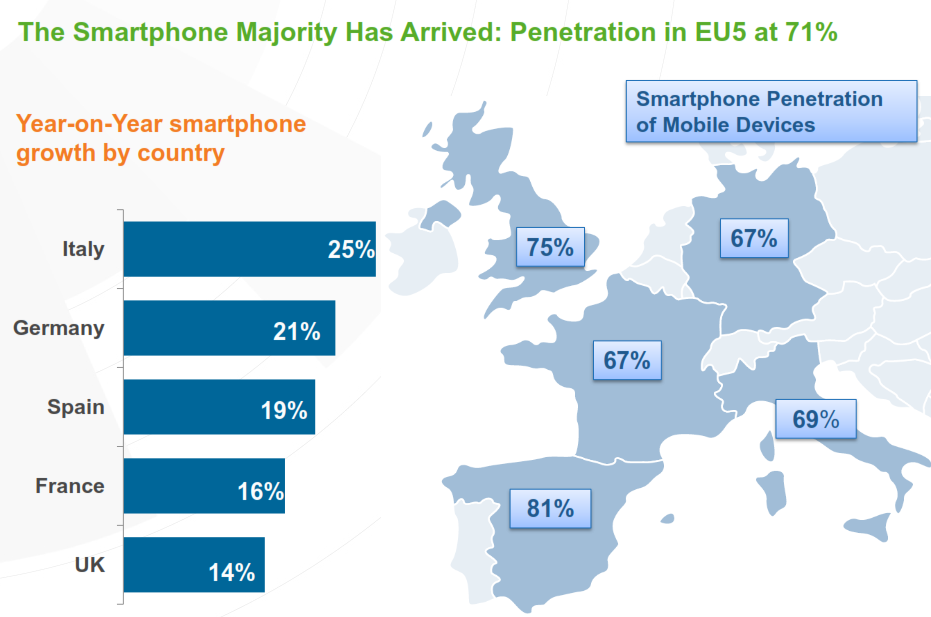

As the following infographic demonstrates, smartphone penetration in the EU5 is now 71%. Moreover, the EU5 countries are experiencing double-digit year-on-year smartphone growth:

Italy has the highest year-on-year smartphone growth (25%), and the UK lags behind at a more modest 14%. Statistics from comScore Data Mine indicate that mobile adoption is particularly strong in Italy; 64.1% of the total Italian mobile audience were smartphone users. Mobile commerce is playing an increasingly important role in online retail in Italy, and the usage of retail apps and sites showed a strong year-over-year increase of 74.8%.

On the other hand, when it comes to smartphone penetration by country, the UK emerged at the top with 75%. Mobile platforms are highly developed in the UK, and play an increasingly vital role in consumers’ purchase journeys, which incorporate multiple digital devices. The comScore study also revealed that two distinct smartphone shopping and buying behaviors have emerged across the EU5: m-shopping and m-buying.

EU5 consumers who went “m-shopping” accessed online sites to research different products and services and compare prices. Those who went “m-buying,” on the other hand, made online purchases using their mobile devices.

Finding a store (21%) and comparing prices (20%) are the two most popular online shopping activities performed on smartphones. Other less popular online shopping activities include researching products (18%), looking for deals and coupons (16%), making shopping lists (15%), and checking product availability (14%).

When it comes to the most popular in-store shopping activities performed on smartphones, taking photos of products (25%) and sending photos of products (18%) emerged at the top. Other less popular in-store shopping activities performed on smartphones include scanning barcodes (11%), comparing prices (9%), looking for store locations (7%), and researching products (6%).

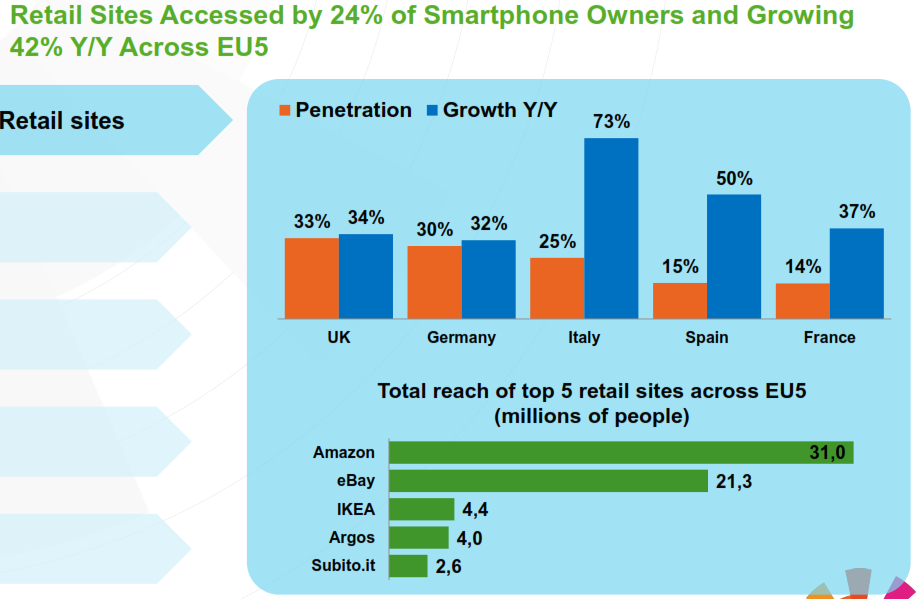

The study also revealed that 24% of smartphone owners in the EU5 accessed retail sites, with year-on-year growth in this sector hitting 42% across the region. As for the individual countries, when it comes to smartphone access to retail sites, Italy had the highest year-on-year growth (73%), though only 25% of Italian smartphone owners accessed retail sites.

The lowest year-on-year growth in this sector was in Germany (32%), though the number of smartphone owners who accessed retail sites was much higher in Germany (30%) than in Italy. French smartphone owners were the least likely to access retail sites (14%) across the EU5.

The top five retail sites across the EU5—with their total audience reach in the millions—are as follows: Amazon (31 million), eBay (21.3 million), IKEA (4.4 million), Argos (4 million), and Subito.it (2.6 million).

Auction and classified sites, on the other hand, were accessed by 19% of smartphone owners across the EU5, with a year-on-year growth rate of 30%. The top five auction and classified sites across the EU5, with their total audience reach, are as follows: eBay (28.2 million), Gumtree (2.4 million), Auto Trader (1 million), AutoScout24 (900, 000), and Mobile.de (900, 000).

Travel sites, while accessed by only 12% of smartphone owners across the EU5, experienced a strong year-on-year growth rate of 41% in the region. As for the individual countries, Italy had the highest year-on-year growth (56%), though only 18% of Italian smartphone owners accessed travel sites. Across the EU5, German and French smartphone owners were least likely to access travel sites (9%).

The top five travel sites across the EU5—with their total audience reach in the millions—are as follows: Booking.com (5.4 million), TripAdvisor (5 million), Expedia (4.1 million), trivago (3.9 million), and Lastminute.com (3.2 million).

Mobile Commerce in Continental Europe Still Lags Behind Other Markets

As noted in the March eMarketer report, mobile commerce and mobile platforms in continental Europe haven’t achieved the same level of sophistication that is enjoyed in more developed markets. According to the March eMarketer report, relatively few people in Western Europe bought products and services using their mobile devices, and those that did mainly purchased low-priced items, such as books, music, games, and apps.

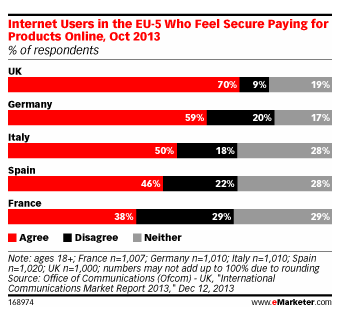

When it comes to the EU5 region, the UK had the highest number of Internet users who declared that they felt secure playing for products online (70%). The rest of the EU5 had noticeably fewer netizens who felt secure paying for products online: Germany (59%), Italy (50%), Spain (46%), and France (38%).

The findings of the comScore study corroborate the findings of the March eMarketer report. According to the comScore study, the top purchasing categories for EU5 smartphone owners who made at least one monthly purchase were for relatively low-priced items:

Only 17% of smartphone owners in the EU5 region purchase products and services on their smartphones at least once a month. Year-on-year growth across the EU5 region in this sector was 42%, and the UK and Italy were the leading markets when it came to year-on-year growth (34% and 70% respectively).

Additionally, more than half (54%) of smartphone purchasers across the EU5 region were male, with 25-34 year olds being the largest age segment. The smallest age segment of smartphone purchasers were minors in the 13-17 age segment.

Mobile Commerce in the United States is More Robust

Compared to the embryonic state of mobile commerce in the EU5 and the rest of Western Europe, mobile commerce in the United States is highly developed. According to the comScore report, “mobile, especially smartphones, has become the primary medium for consumers to engage with retail brands online.”

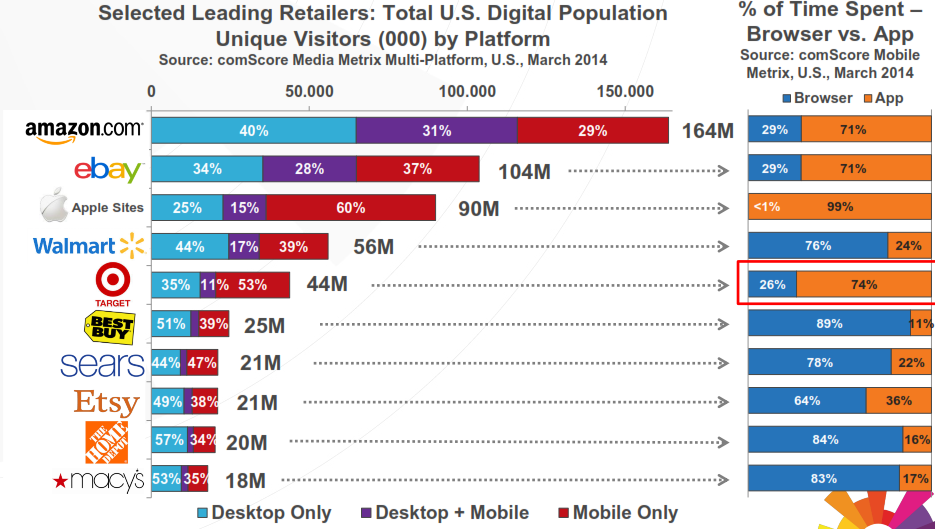

By March 2014, 43% of American consumers engaged with retail brands online via smartphone. In contrast, only 19% used tablets and 38% used desktop within the same period. In addition, a significant percentage of top retailers’ audiences were multi-platform and mobile-only, though there was a wide variation between mobile app versus browser splits, with pure plays relying heavily on apps.

Of Amazon’s 164 million unique visitors for March 2014, 31% used both desktop and mobile, while 29% used mobile only to access the site. eBay, another major online retailer which drew 104 million unique visitors in March 2014, had an audience of 28% desktop and mobile, and 37% mobile only.

These statistics demonstrate that Americans are more comfortable m-shopping and m-buying using multiple platforms, Hence, marketers and retailers are more willing to invest in the development of highly sophisticated digital channels to meet the needs of their savvy customers.

Mobile commerce in the United States reached $7.3 billion, and accounted for nearly 12% of total digital dollars in Q1 2014. “In terms of discretionary spending, m-Commerce growth is still outpacing e-Commerce and bricks-and-mortar [establishments],” states the comScore report.

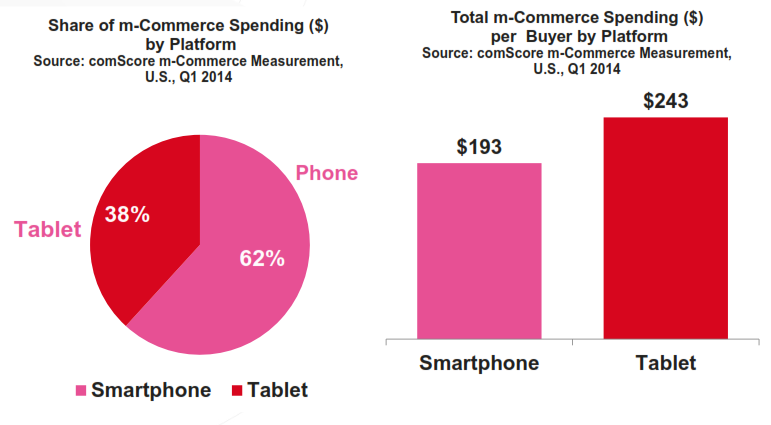

Also, because phones outnumber tablets, mobile devices accounted for 6 in 10 mobile dollars being spent in the United States. However, tablet buyers demonstrate higher spending per buyer:

Mobile Commerce in the EU is Poised for Immense Growth

According to a Forrester study which forecasted mobile commerce growth across the EU, revenues from mobile commerce are projected to rise from €1.7 billion in 2011 to €19.2 billion in 2017, reaching 6.8% of total web sales. Merchandise categories that will generate the most sales are books, DVDs, music, and event ticketing.

The projected €19.2 billion by 2017 figure includes retail products, services, magazine subscriptions, and online purchases made for in-store pickup. High growth is projected for the UK and Italy, and the Forrester study stated that Germany would be at the bottom of the list because of its much slower smartphone adoption rates.

Retailers and online marketers that have customer bases in Western Europe should invest in their mobile commerce strategies to leverage this growth. By creating more viable multi-platform digital channels, retailers and online marketers can better meet the needs of increasingly tech-savvy consumers in Europe.

Marketing Digest Writing Team

Latest posts by Marketing Digest Writing Team (see all)

- How Taco Bell Struck Gold with Its Memorable Viral Marketing Campaigns - September 15, 2015

- Salesforce Marketing Cloud Releases New Instagram Marketing Tools - September 12, 2015

- Chrome Begins Pausing Flash Ads by Default to Improve User Experience - September 3, 2015